2024

IN FIGURES

Financial contribution

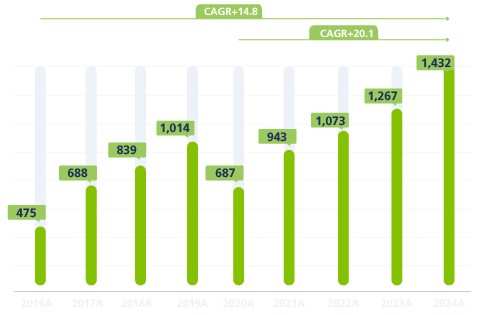

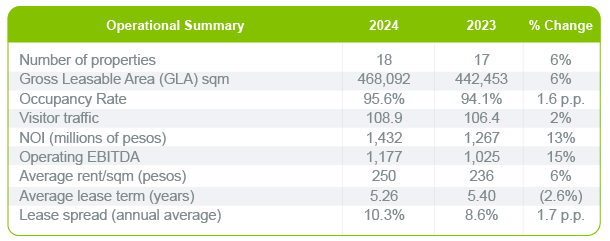

In 2024, our Net Operating Income (NOI) (cash flow basis) reached Ps. 1,432 million, representing a 13% growth compared with the Ps. 1,267 million reported in 2023. As a result, we achieved a lease spread of 10.3%.

This growth is attributable to our commercial strategy and a strategic focus on maintaining high occupancy levels and attracting more visitor traffic, which has boosted our tenants' sales. Thanks to these actions, we have experienced occupancy of 95.6% and visitor traffic of 109 million people.

This positive performance reflects the company's financial strength, supported by efficient management and a favorable business environment.

The portfolio's revenues come from:

- Base Rents

- Variable Rents (percentage of sales from tenant)

- Common Areas (parking, advertising, rental common spaces)

- Lease Fees

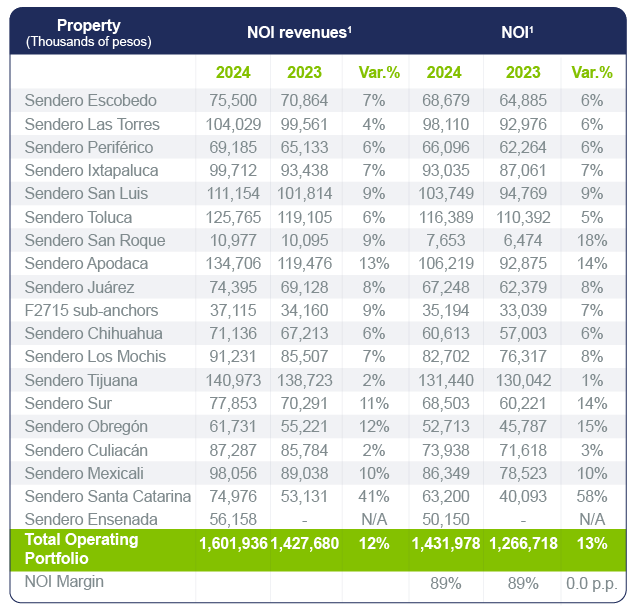

NOI results on a cash flow basis as of December 31, 2024 were:

1 The information is reported on a Cash Flow Basis and not on an Accrual Basis. Additionally, due to rounding issues, the sum of the partial amounts may not add up to the total. Includes 100% of the revenues of the joint venture that AV has in the CIB 2715 Trust, which is not consolidated in AV. The information of the shopping centers is presented including minority interest. AV owns: Chihuahua 56.9%, Los Mochis 56.9%, Tijuana 75.6%, Sur 75.6%, Obregon 75.6%, Culiacan 75.3%, Mexicali 100%, Santa Catarina 40% and CIB Trust F2715 50%.

Efficient NOI Growth

(In millions of pesos)

The following chart shows the behavior of the NOI during the last 7 years.

RESULTS ANALYSIS

AND DISCUSSION

As of December 31, 2024, the northeast region accounted for 28% of contracted rents, with an occupancy rate of 93.7% and an average annual contracted rent of Ps. 241 per square meter.

The Plaza Sendero shopping centers located in the northwest region of the country contributed 50% of contracted rents, closing the year with an occupancy rate of 95.9% and an average annual contracted rent of Ps. 216 per square meter.

In the central region of Mexico, contracted rents represented 15% of the total, with occupancy of 98.1% and an average contracted rent of Ps. 377 per square meter.

The north-central region accounted for 7% of contracted rents, with an occupancy rate of 99.6% and an average contracted rent of Ps. 386 per square meter.

These four regions have been favored by the growth of nearshoring, especially due to the relocation of Asian industries, which has boosted local economic activity. The strategic location of the Plaza Sendero shopping centers continues to be one of our main strengths, as they are located within some of the most dynamic industrial corridors in the country.

CONSOLIDATED INCOME

RESULTS

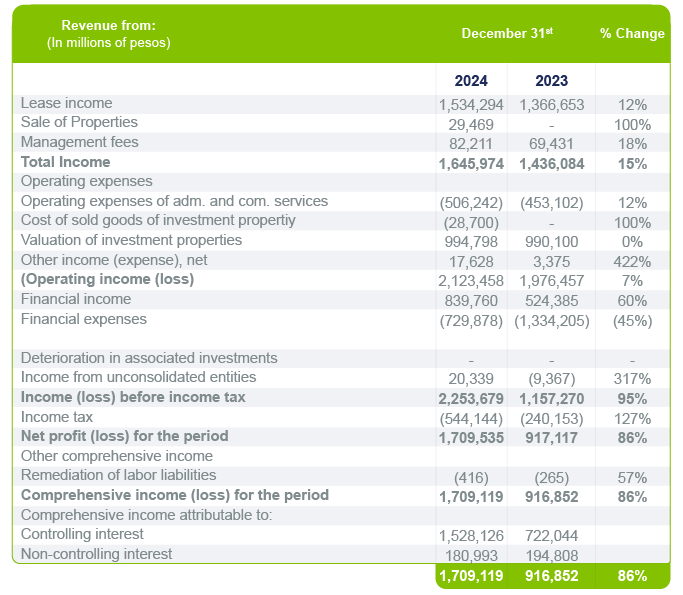

Income Statement

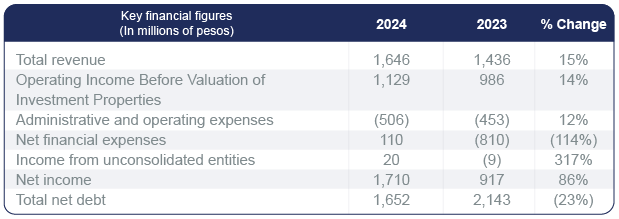

In 2024, we reported Ps. 1,646 million in total revenues, representing a 15% increase compared with 2023. This growth was driven mainly by the solid performance of rental revenues, which recorded a double-digit increase, reaching 12% year-over-year growth. In addition, the incorporation of revenues from the sale of the Santa Catarina land as well as higher income from management services contributed positively to the period’s results.

Operating expenses and cost of sales totaled Ps. 535 million, an increase of 15% compared to the previous year. This increase is mainly attributable to the recognition of the cost of sale of the land in Santa Catarina as well as an increase in professional fees related to non-recurring corporate processes. Excluding these extraordinary effects, operating expenses remained in line with the trend observed in previous years.

As a result of the combined effects, consolidated net income for the period totaled Ps. 1,710 million, an 86% increase from Ps. 917 million in 2023. This performance reflects not only the growth in recurring revenues from leasing and services, but also a significant improvement in the net financial result, which went from a loss to a profit as a result of favorable exchange rate and financial instrument valuation effects.

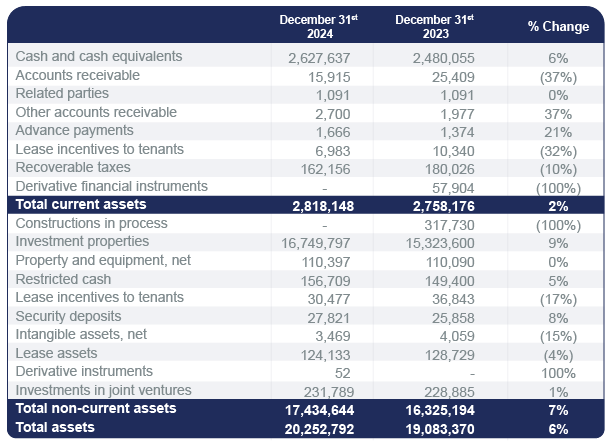

Balance sheet

In 2024, our net assets totaled Ps. 20,253 million, an increase of 6% compared with the same period of the previous year. This growth was driven mainly by a 9% increase in the value of investment properties, derived from appraisal updates and the incorporation of the Plaza Sendero Ensenada, which opened in April 2024. In addition, cash and cash equivalents grew 6%.

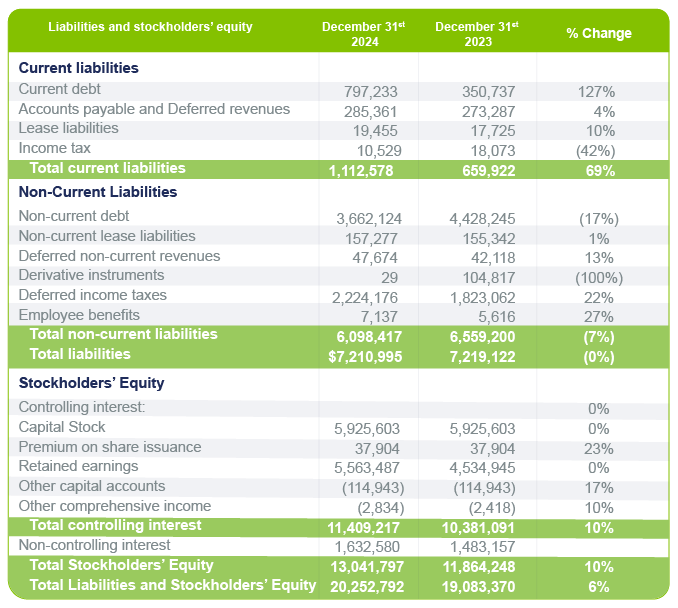

Our net liabilities stood at Ps. 7,211 million, with no significant changes compared to year-end 2023. Current liabilities increased 69%, mainly due to the reclassification of long-term debt to short-term. Non- current liabilities decreased by 7%, due to the reduction of non-current debt. However, we are in the process of restructuring this debt, which we expect will allow us to reclassify the debt back to long-term in the near future.

As a result of corporate performance, the leverage level stood at 10% in 2024, compared to 13% in 2023.

Stockholders’ equity

At year-end 2024, stockholders’ equity reached Ps. 13,041 million, representing a 10% increase compared to 2023, while maintaining the number of shares outstanding at 60,034,937. This growth was driven mainly by an increase in retained earnings, which rose from Ps. 4,535 million in 2023 to Ps. 5,563 million in 2024.