At Acosta Verde, Corporate Governance is the basis for

responsible, ethical and transparent management. Our commitment

to sustainability is reflected in the alignment of our strategies with

best corporate governance practices, ensuring the generation of

long-term value for our stakeholders.

Our governance model is based on the strategic oversight

of a strong Board of Directors and specialized committees

that ensure the integration of ESG factors in decision

making. Through this framework, we promote responsible

leadership, mitigate risks, and foster a culture of integrity

that strengthens the trust of our investors, employees,

and strategic partners.

HIGHLIGHTS

INTEGRITY AT ALL TIMES

CORPORATE

GOVERNANCE

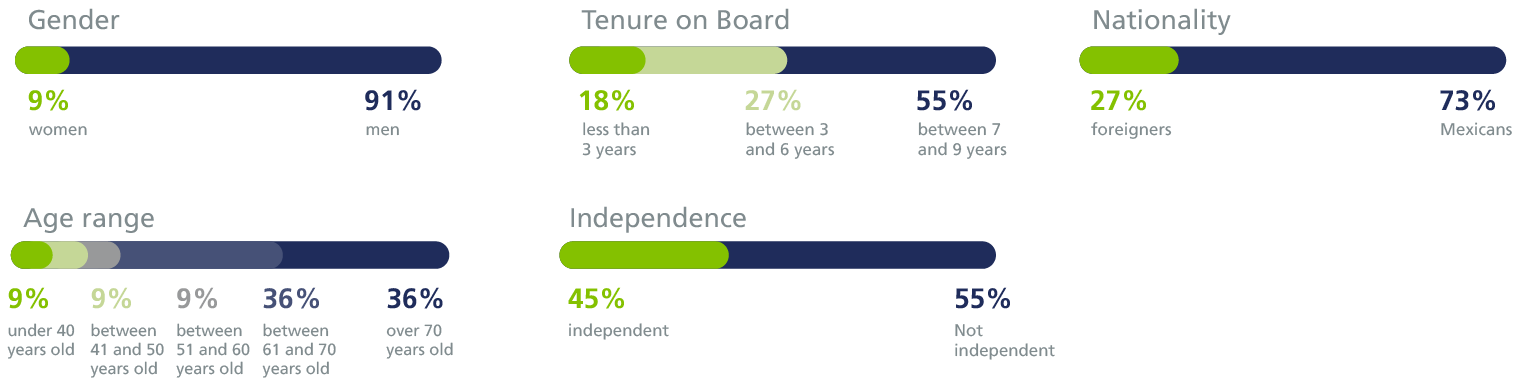

- 45% of Board members are independent

- 9% of women on the Board of Directors

RISK MANAGEMENT

AND COMPLIANCE

- Implementation of the COSO framework for risk identification, assessment and monitoring.

- Continuous risk assessment in operational, strategic, legal, political and reputational areas.

TRANSPARENCY AND

BUSINESS ETHICSL

- Anti-corruption training for team members and supplier evaluation under FCPA (Foreign Corrupt Practices Act)

standards.

- Ethics Action Line for reporting irregularities, managed by an independent supplier.

- Zero cases of corruption by 2024.

HUMAN

RIGHTS

- We participate in the Business and Human Rights Accelerator Program of the United Nations

Global Compact.

CYBERSECURITY AND DATA

PROTECTION

- Vulnerability analysis and phishing tests.

- Cybersecurity training for team members through online training modules.

CORPORATE GOVERNANCE

STRUCTURE

GRI

2-9, 2-10, 2-11, 2-12, 2-13, 2-17

At Acosta Verde, our Board of Directors is the pillar of strong corporate governance, based on transparency, accountability and alignment

with ESG best practices.. Its main function is the oversight and approval of corporate strategies, ensuring that decisions are governed by

principles of ethics, integrity and sustainability. To strengthen decision-making, the Board works in close coordination with senior management

and specialized committees, promoting risk management, regulatory compliance and the integration of ESG factors in the company’s operations.

At the end of 2024, the Board of Directors was comprised of 11 members, of which five are independent, ensuring an appropriate balance

between experience, independence and diversity of perspectives.

Distribution of the Board:

45%

of the

members are independent

55%

of the Board members have more than 7 years of experience on the Board.

Jesús Acosta Verde is the Chairman of the Board.

Board of Directors nomination process

The Nominations Committee is responsible for the search,

evaluation and proposal of candidates for the Board, with a

focus on experience, independence and alignment with ESG

principles. This process is carried out under the guidelines

of the Securities Market Law (LMV) and industry’s best

practices.

In accordance with the Company’s bylaws, the following

criteria must be met:

- The members of the Board of Directors may or may not

be shareholders of the Company and must have the

legal capacity to perform their duties.

- Each proprietary director may have an alternate, and in

the case of independent directors, their alternate must

also comply with this characteristic.

- At least 25% of the directors must be independent.

- Both the Chairman of the Board of Directors and the

Secretary are appointed by the General Shareholders’

Meeting.

At Acosta Verde, we recognize the importance of having a Board

of Directors that is informed and aligned with best practices in

sustainability. For this reason, in 2024 we will continue with ESG

training for its members, with the objective of strengthening

their knowledge of global trends, emerging regulations and key

frameworks for sustainability management and disclosure.

During the year, sessions included topics such as:

- GAV today and key ESG Frameworks

- Current climate standards disclosure overview

- ESG certifications

- ESG reporting standards

This program will be maintained on a quarterly basis, ensuring that our advisors continue to be

updated on sustainability best practices and the integration of these factors into the company’s

strategy.

Expertise by topic:

36%

Cybersecurity

experience

100%

Experience on other

Boards

BOARD OF DIRECTORS

DIVERSITY

Sessions of the Board of Directors in 2024

- February 21, 2024*

- March 4, 2024

- March 21, 2024

- April 23, 2024*

- July 24, 2024

- September 30, 2024

- October 23, 2024

- December 9, 2024

* Progress on ESG issues

At Acosta Verde we promote a diverse Board of Directors, made up of members with broad experience in strategic and relevant issues

for the Company. We value the integration of different perspectives, considering their professional background, knowledge, gender,

nationality and length of time on the Board, to strengthen decision making and guarantee an integral vision in the management of the

company

E The Board of Directors is supported by four operating

committees, which play a key role in supervision and

strategic decision-making. The selection of its members is

carried out in accordance with the provisions of the Securities

Market Law (LMV), ensuring that each committee has the

participation of independent directors, which strengthens objectivity and transparency in its operation..

Audit and Corporate Practices Committee

Compensation Committee

Investment Committee

Nominations Committee

AUDIT AND CORPORATE PRACTICES COMMITTEE

Members

- Paulino Rodríguez

- Javier Astaburuaga Sanjinés

- Francisco Javier Garza Zambrano (Independent President)

2024 sessions

- February 21, 2024

- March 4, 2024

- April 23, 2024

- July 24, 2024

- October 23, 2024

Main dutiess

The Audit and Corporate Practices Committee is responsible for

supervising and evaluating the Company’s financial, accounting

and internal audit processes, ensuring transparency and regulatory

compliance. Its main functions include:

- Evaluating the performance of the financial, accounting and internal

audit auditor, as well as the cooperation received during the audit

process.

- Pre-approve all audit services, including the fees and terms agreed

with the independent auditors, or establish policies for their prior

approval.

- Issue opinions on internal control and internal audit mechanisms.

- Analyze and evaluate risk identification, management and control

mechanisms.

- Investigate violations of internal policies, regulations and control

points established in the audit systems.

- Report any irregularities to the Board of Directors and propose the

necessary corrective actions.

- Verify that the evaluation of the Company’s assets complies with the

guidelines of the Board of Directors.

- Review with tax and management advisors relevant tax issues and

potential disputes.

- Supervise the function of the internal audit department, ensuring its

independence, authority and compliance with its duties.

- Validate transactions with related parties and review the Company’s

policies in this regard.

Members

- Jesús Acosta Verde

- Enrique Alejandro Castillo Badia

- Federico Chávez Peón Mijares

- Paulino José Rodríguez Mendívil

Alternates

- Jesús Adrián Acosta Castellanos

- Lisa Rae Reichenbach

- Juan Ignacio Enrich Liñero

- N/A

Main duties

The Compensation Committee is responsible for defining and overseeing compensation

strategies for senior management, ensuring that they are aligned with the Company’s strategic

objectives. Its main functions include:

- Reviewing and approving corporate goals and objectives related to the CEO’s

compensation.

- Annually evaluate the performance of the Chief Executive Officer based on such goals

and objectives, determining and approving his compensation in accordance with the

results obtained.

- Authorize the compensation of key officers, considering the CEO’s recommendations and

approving it as part of the annual budget.

Members

- José María Garza Treviño

- Enrique Alejandro Castillo Badia

- Federico Chávez Peón Mijares

- David Contis

Alternates

- Diego Acosta Castellanos

- Lisa Rae Reichenbach

- Juan Ignacio Enrich Liñero

- N/A

2024 sessions

- Did not session during 2024

Main duties

The Investment Committee is responsible for evaluating and supervising the Company’s financial strategies, ensuring efficient management of resources and aligning corporate

objectives. Its main functions include:

- Review all investment, disposition and financing proposals in excess of US $5 million.

- Discuss and recommend to the Board of Directors the investment policies and financial

guidelines of Acosta Verde.

- Monitor and periodically review the performance of all previously approved investments,

ensuring alignment with the Company’s strategy.

Members

- Jesús Acosta Verde

- Lisa Rae Reichenbach

- Federico Chávez Peón Mijares

- Francisco Javier Garza Zambrano

Alternates

- Jesús Adrián Acosta Castellanos

- Adam Kost

- Juan Ignacio Enrich Liñero

- N/A

2024 sessions

- Did not session during 2024

Main duties

GRI 2-19, 2-20

The Nomination Committee is responsible for guaranteeing the appropriate composition of the

Board of Directors and its committees, ensuring that they have independent and highly qualified

members. Its main functions include:

- To seek, analyze and evaluate independent candidates to integrate the Board of Directors.

- Propose to the Board of Directors the list of Board members eligible for election at the

Shareholders’ Meeting.

- Recommend independent candidates for positions on the various committees of the Board.

- Annually evaluate the compensation of the independent members of the Board and its

committees, making recommendations on compensation adjustments.

- Supervise and manage potential conflicts of interest among independent directors, ensuring

integrity in decision-making.

GRI

2-9, 2-13, 2-19, 2-20

Acosta Verde’s management team is responsible

for designing, executing and ensuring the correct

implementation of the business strategy. In addition,

it

is committed to following and implementing the

recommendations issued by the Board of Directors and

its committees, ensuring management is aligned with

corporate objectives and best governance practices.

Compensation at Acosta Verde is managed in a structured manner

and in compliance with corporate governance processes:

- The compensation of the Chief Executive Officer is approved

by the Board of Directors.

- The compensation of the independent members of the Board

of Directors is authorized by the Shareholders’ Meeting.

- All other compensation within the Company is analyzed and

discussed by the Compensation Committee.

As for our team members, the compensation structure includes

a fixed and a variable portion, ensuring incentives aligned with

performance. Additionally, the variable compensation of the Chief

Legal and Operations Officer, responsible for the sustainability

area, is linked to the fulfillment of strategic objectives, including

ESG goals, thus reinforcing our commitment to sustainability and

responsible performance.

Jesús A. Acosta Castellanos

CEO

Edgar Maldonado de los Reyes*

CFO

Hernán Treviño De Vega

Chief Legal and Operations Officer

Carlos Ruiz Santos

Chief Commercial Relations Officer

Edgar Maldonado de los Reyes is retiring from Acosta Verde on

March 31, 2025, and will be replaced by Rosalinda Fernández

Castillón. For more information, please refer to the relevant event.

At Acosta Verde, we recognize that risk management is

a fundamental pillar to guarantee the sustainability and

continuity of our business. We understand that risk exposure

is inherent to our operations, so we adopt a comprehensive

approach that allows us to identify, evaluate and mitigate

potential impacts on our processes. To do so, we consider

operational, economic, financial, regulatory, social and

environmental factors, ensuring informed decision making

aligned with our strategic objectives.

Currently, our risk management methodology is based

on the COSO (Committee of Sponsoring Organizations)

framework, which allows us to structure a solid process

of risk identification, analysis, evaluation and monitoring.

This strategy helps us to implement timely and effective

controls that reinforce the stability and resilience of the

organization.

Our risk management process is comprised of six key

steps designed to ensure appropriate and timely treatment

of risks throughout the company.

Monitoring and strengthening risk management

In 2024, we conducted a comprehensive update of the company’s

risk matrices, allowing us to comprehensively assess current risks

and ensure that the controls in place are aligned with strategic

objectives and corporate standards.

This process not only strengthens our ability to respond to

operational challenges but also allows for a more accurate analysis

of the effectiveness of mitigating controls. In addition, we foster

an organizational culture in which our team members actively

participate in the identification and reporting of potential risks at all

levels of the company, in line with the COSO methodology.

As part of our internal control strategy, in 2024 we initiated a risk

identification and documentation process to establish preventive

controls and reduce exposure to potential threats. In this regard, we

have identified and managed the following key risks:

- Administrative / Operational Risk: Internal processes,

operational efficiency and business continuity.

- Strategic Risk: Impact of strategic decisions on the

company’s sustainability.

- Legal Risk:Regulatory compliance and potential litigation.

- Political Risk:Changes in government regulations or

policies.

- Reputational Risk: Public perception and stakeholder trust.

- Systems Risk: Cybersecurity, data integrity and information

protection.

Through this comprehensive approach, Acosta Verde continues to

strengthen our ability to anticipate, manage and mitigate risks, thus

ensuring a resilient operation aligned with our sustainability strategy.

At Acosta Verde, we maintain a zero-tolerance policy for corruption,

ensuring that our operations are governed by the highest standards

of ethics and transparency. We are committed to corporate integrity,

implementing strict controls that reinforce a culture of compliance

and mitigate any risk of improper practices.

To this end, we adopt the best practices and international anti

corruption standards, ensuring compliance with key regulations,

such as the Foreign Corrupt Practices Act (FCPA), which prohibits

any act of bribery, whether direct or indirect, of public officials to

obtain improper advantages.

Prevention Strategy and Measures

Our anti-corruption and anti-bribery strategy is supported by a series of measures and controls that ensure transparency in our operations, including:

Anti-corruption policy

Guiding document that establishes strict guidelines to

prevent and sanction any act of corruption.

Internal compliance team

Attached to the Legal and Operations Department,

in charge of monitoring and enforcing anti-corruption policies.

Continuous training

Ethics and corruption prevention training for team

members and suppliers.

Supplier evaluation

Review of compliance with anti-corruption standards

before establishing business relationships.

Contracts with anti-corruption clauses

All leasing and service agreements include specific

provisions to ensure transparency.

Results and Compliance in 2024

During 2024, we strengthened our actions to ensure

compliance with our anti-corruption policies and adherence

to FCPA standards. As a result:

- 100% of our 745 supplier transactions were

assessed for corruption risks under FCPA standards.

- 100% of supplier contracts include an anti-corruption

clause.

- 100% of team members and suppliers were informed

about our anti-corruption policies and procedures.

- 90% of team members at Plaza Sendero shopping

centers received training on anti-corruption and

internal FCPA policy.

- 100% of new team members completed training on

anti-corruption and FCPA policy guidelines.

Commitment to Transparency

In 2024, there were no confirmed cases of corruption

in our operations, and no monetary losses arising from

legal proceedings related to professional integrity, fraud,

negligence, or regulatory non-compliance.

These results reflect our strong commitment to

transparency, business ethics and regulatory compliance,

ensuring that our operating practices remain aligned with

the highest standards of integrity.

GRI

2-15, 2-16, 2-23, 2-26, 2-27

At Acosta Verde, ethics and transparency are the fundamental

pillars of our organizational culture and our way of doing business. We believe that management based on principles of integrity,

responsibility and regulatory compliance is essential to generate

trust with our stakeholders and ensure the sustainable growth of

the company.

Our commitment to business ethics is reflected in the implementation

of policies, regulations and control mechanisms that ensure the

adoption of best practices in governance. Through our Code of

Ethics, we establish the principles that guide the conduct of our

team members, managers and business partners, promoting a work

environment based on respect, fairness and accountability.

In addition, we have whistle-blowing systems and confidential

communication channels designed to detect and prevent any type of

improper practice, thus reinforcing our commitment to transparency.

At Acosta Verde, we implement a due diligence process for the

evaluation of new projects and the acquisition of operating assets.

This analysis allows us to ensure that each investment meets

sustainability and regulatory compliance criteria, aligned with our

principles of responsible operation.

During this phase, we review the following factors:

- Environmental studies and assessments, including Phase I

Studies and Environmental Impact Studies.

- Compliance with municipal, state and federal environmental

regulations.

- Land use review to ensure the viability of new Plaza Sendero

shopping centers.

- Road impact studies, ensuring accessibility and mitigation of

impacts.

- Waste management analysis, promoting sustainable

practices.

- Evaluation of water and energy consumption, promoting

operational efficiency.

- Measurement of greenhouse gas emissions, with a focus on

reduction and mitigation.

- Community impact, ensuring responsible social and

environmental integration.

- Value generation, prioritizing long-term benefits for our

stakeholders.

This process allows us to make informed decisions aligned with our

commitment to sustainability and responsible growth.

At Acosta Verde, we believe that ethics, transparency and

accountability are fundamental principles that guide the

way we operate and make decisions. Our Code of Ethics

establishes guidelines that govern the conduct of all team

members, managers and business partners, ensuring a

work environment based on integrity, respect and fairness.

This document defines our commitments in terms of

business practices, regulatory compliance and stakeholder

relations, promoting an organizational culture aligned with

the highest standards of governance.

The Code establishes guidelines on working conditions,

safety in the workplace, interactions with third parties,

safeguarding of information, prevention of corruption and

money laundering, management of conflicts of interest,

human rights, and our responsibility to the environment and

the community.

COMPLAINTS

REPORTING SYSTEM

We have an Ethics Action Line, a reporting system accessible

to all our stakeholders. This mechanism is managed by

Ethics Global, an independent provider that guarantees the

management of reports in an impartial, orderly and confidential

manner.

Through this platform, anyone can report possible breaches

of the Code of Ethics or our internal policies.

Ethics Action

Line

01 800 04 38422

Each complaint received is channeled to the Ethics Committee,

which is responsible for its analysis and determines the

corresponding measures or sanctions.

Transparency mailbox 2024

Complaints received during the period

Complaints closed during the period

Complaints that were not closed during the

period

Complaints received during the period that are

in the process of being closed.

Complaint that was unfounded

Tipo de denuncias buzón de transfarencia

- 1 Inappropriate treatment of clients (25%)

- 2 Transactions (50%)

- 1 Related to harassment or discrimination (25%)

Compliance with laws and regulations

GRI 2-27

In line with our commitment to operate in compliance with current

regulations, in 2024 we received no fines or penalties for non

compliance with laws and regulations applicable to the Company.

GRI 207-1, 207-2, 207-3

We maintain a firm commitment to responsible compliance with our

tax obligations, applying internal procedures based on principles

of ethics and good corporate governance. Our tax strategy is

supervised by the Finance Department and endorsed by the Audit

and Corporate Practices Committee, guaranteeing the correct

application of tax regulations.

We conduct a monthly evaluation of our tax compliance and submit

tax opinions reviewed by external auditors. In addition, we disclose

detailed information and reconciliations of the company’s taxes in

the notes to the annual financial statements.

The management of our tax responsibilities is carried out in strict

compliance with current legislation, maintaining an open channel

of communication with the tax authority. This relationship allows

us to adapt to regulatory changes, meet requirements and ensure

an operation aligned with the best practices of transparency and

compliance.

At Acosta Verde, we recognize the dignity and freedom of all

people, promoting a work environment based on respect, equality

and inclusion. We are committed to guaranteeing compliance with

Human Rights within our organization, in our value chain and in the

communities where we operate.

We reject any form of discrimination, child labor, forced labor and

human trafficking. We promote gender equity, freedom of association

and participation in collective agreements, guaranteeing fair and

safe working conditions for all our employees. We also strictly

prohibit harassment, coercion and threats, ensuring an environment

of respect and integrity.

Additionally, in 2024 we participated in the Business and Human

Rights Accelerator Program, which aims to help organizations

identify, manage and communicate their impact on human and

labor rights, aligning with international standards such as the

Universal Declaration of Human Rights and the ILO Declaration on

Fundamental Principles and Rights at Work.

Through evaluations, workshops, knowledge sharing among

employees and dialogues among various stakeholders, we were

given tools to identify our responsibilities in respecting human and

labor rights, establish a continuous due diligence process, following

international standards and how to report and communicate on our

progress in human rights, including compliance with the United

Nations Global Compact’s Communication on Progress (CoP).

To ensure compliance with these policies, we have an Ethics Action

Line, operated by an independent third party, where employees and

stakeholders can confidentially report any non-compliance.

To learn more about our policies visit our website.

CYBERSECURITY AND

INFORMATION PROTECTION

At Acosta Verde, cybersecurity is a strategic priority to guarantee the

protection of information, operational continuity and the trust of our

stakeholders. Aware of the constant evolution of digital threats, we

have strengthened our technological infrastructure and our security

protocols, ensuring proactive management of cyber risks.

In 2024, we conducted our annual vulnerability analysis with the

support of a consultant specializing in cybersecurity. This process

included:

- External tests (“pentest”) to evaluate the resistance of our

systems to simulated attacks.

- Internal testing to detect security breaches within the digital

infrastructure.

- Social engineering to measure the susceptibility of personnel

to manipulation and fraud attempts.

The results reflected a significant improvement over the previous

year, highlighting the effectiveness of our security patch management

policies and controls.

Operating System Update Management

During the year, we reinforced our patch update policy with a

preventive approach to mitigate risks of software vulnerabilities. We

implemented a model that:

- Aligns updates with manufacturers’ schedules for agile

response to new threats.

- Increases patch deployment frequency, reducing exposure to

security risks.

Backup System Modernization

To strengthen the protection and availability of information, we

implemented a new backup system that:

- Optimizes data backup and recovery times.

- Increase restoration points to improve operational continuity.

- Integrates new functionalities for greater shielding against

cybersecurity incidents.

Disaster Recovery Strategy (DRP)

Strategic adjustments were made to our Disaster Recovery Plan

(DRP) infrastructure, enabling:

- Improved restoration capacity in case of incidents.

- Significant reduction in contingency response time.

Cybersecurity Training and Culture

To strengthen the awareness and preparedness of our employees, we implemented various training initiatives: